The implementation of the "Strengthening Fiscal Justice" project funded by the Norwegian Development Agency (NORAD) and coordinated by Tax Justice Network Africa (TJNA), therefore provides an opportunity for CSOs to make their voices heard by the Government through the Senators and Deputies who are members of the Platform for Parliamentary-Civil Society Dialogue on the Monitoring and Evaluation of Public Action. A preparatory workshop for an inclusive BOD is organised for this purpose by CRADEC this 13th June 2022.

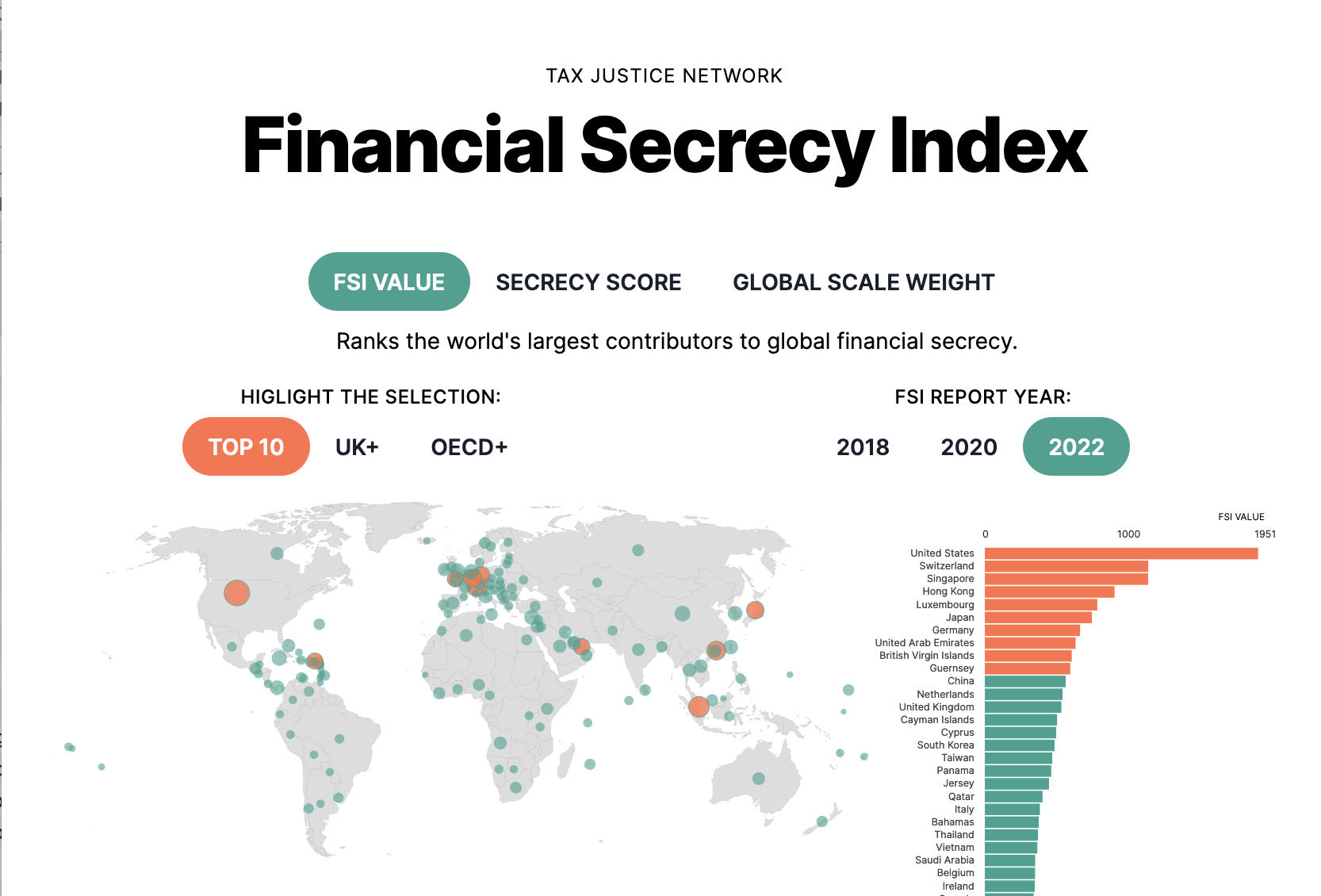

Africa loses about US$ 90 billion per year in illicit financial flows, robbing the continent of resources to finance investment and development. Financial secrecy allows individuals to hide and move money out of the continent and the Financial Secrecy Index 2022, published by the Tax Justice Network, shows that the largest enablers of financial secrecy are some of the richest nations in the world, including the USA and Switzerland.

The Sustainable Development Goals are a call to action for all countries - poor, rich and middle-income - to promote prosperity while protecting the planet. They recognize that ending poverty must go hand in hand with strategies that expand economic growth and address a range of social needs, including education, health, social protection and employment opportunities, while combating climate change and protecting the environment. To do this, Civil Society and the Legislative Branch must come together to contribute to the effective implementation of the SDGs.

Cameroon, Africa in miniature, rich in natural resources, has a poverty rate of nearly 37.5% (2014, World Bank). In 2017, indirect taxes alone accounted for more than 70% of the revenue collected by the Directorate General of Taxes. 40.9% for VAT, 10.4% excise duties, 6.8% for the TSPP 5.7% registration and stamp duties and also 3.5% for the TSR. So 30% is generated by direct tax. This means that Cameroonians, who are mostly poor, pay taxes disproportionately according to their ability.

Civil society organizations members and non members of the EITI Committee Cameroon met again in person this 05 May 2022 in Yaoundé. It was within the framework of a consultation workshop on the theme: For a satisfactory EITI 2023 validation of Cameroon, organized by CRADEC, as part of the implementation of the action "Strengthening Tax Justice in Cameroon", supported by Tax Justice Network-Africa and Norwegian Agency for Development Cooperation (TJNA/NORAD). This meeting followed the first session of the EITI Committee held on March 30. The main objective of the workshop was to advocate for the inclusion of national priorities and beyond in the 2022-2023 work plan for a more effective and satisfactory 3rd validation of Cameroon in 2023.

The debate on media involvement in more responsible public debt management and sustainable development has so far been framed in positive terms and, in doing so, its contradictory dynamics are ignored.African countries must develop institutional mechanisms to foster and nurture a spirit and practice of partnerships and constructive, mutual engagement between the civil society and Medias.

Page 3 of 6